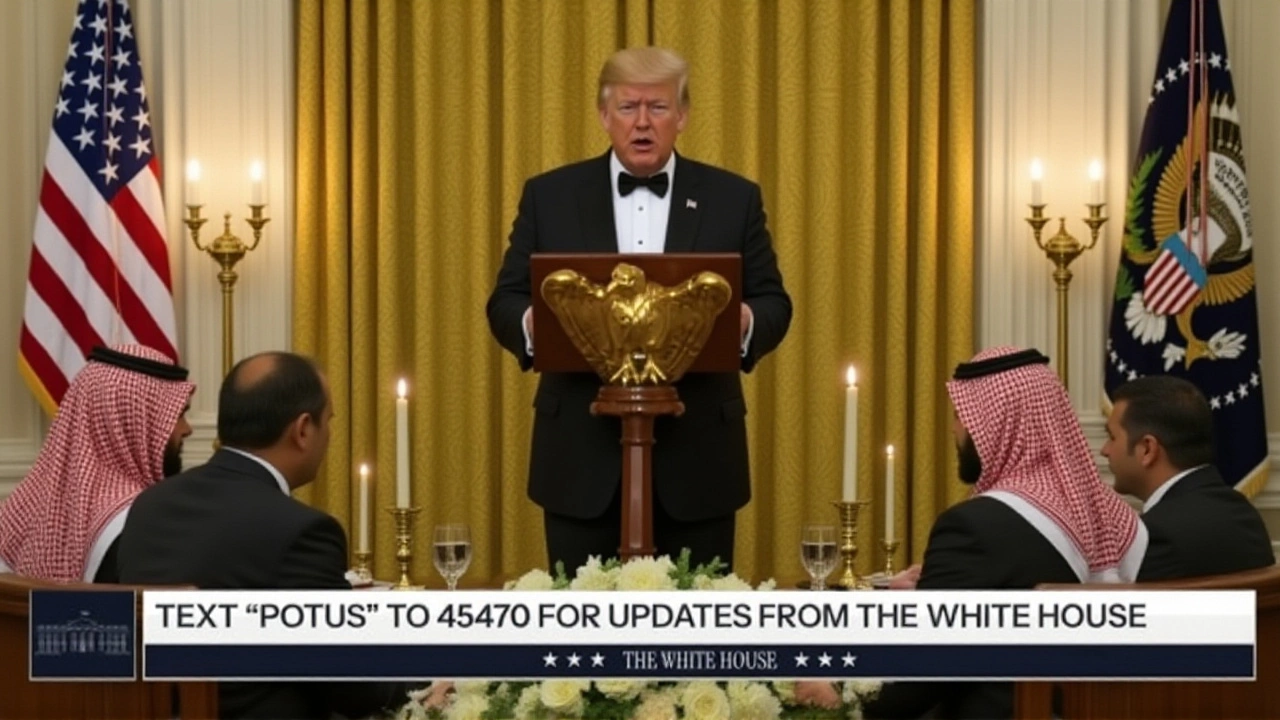

On November 19, 2025, at the White House in Washington, D.C., President Donald J. Trump and Crown Prince Mohammed bin Salman bin Abdulaziz Al Saud, Crown Prince and Prime Minister of the Kingdom of Saudi Arabia, signed a series of sweeping agreements that reshaped the economic and military landscape between the two nations. The centerpiece? A nearly $1 trillion increase in Saudi investment in the United States — a staggering leap from the $600 billion pledged just six months earlier during Trump’s May 2025 trip to Riyadh. But the real shocker was the U.S.-Saudi Strategic Defense Agreement (SDA)Washington, D.C., a formal pact that redefines American military influence in the Middle East — and marks the first time the U.S. has agreed to sell F-35 fighter jets to Saudi Arabia.

From $600 Billion to Nearly $1 Trillion: The Investment Surge

The economic component of the deal wasn’t just an extension — it was an acceleration. Six months after Trump’s Riyadh visit, Saudi Arabia didn’t just honor its commitments; it multiplied them. The White House fact sheet released the next day confirmed the new total: $980 billion in direct investment, infrastructure funding, and technology partnerships across U.S. sectors. That’s more than the entire GDP of Switzerland. And it’s not just about oil money sitting in Treasury bonds. The funds are earmarked for American manufacturing, AI research hubs, and critical minerals processing plants — areas where the Trump administration has made job creation a political rallying cry.At the signing ceremony, Trump turned to GE Aerospace, headquartered in Evendale, Ohio, and shouted, “Where is he? Stand up. What a job you’ve done with your new engines.” He was referring to the next-generation turbofan engines being developed under the new tech partnership — engines that will power not only commercial jets but also future military platforms. The White House confirmed GE Aerospace will receive at least $12 billion in contracts over the next five years, with production lines in Ohio and Kentucky already expanding.

The Strategic Defense Agreement: A New Era in Middle East Security

The U.S.-Saudi Strategic Defense Agreement (SDA)Washington, D.C. is no mere memorandum. It’s a binding framework with three pillars: access, burden-sharing, and alignment.First, U.S. defense contractors — including Lockheed Martin, Raytheon, and Northrop Grumman — now have streamlined access to Saudi military procurement processes. No more years-long bureaucratic delays. Second, Saudi Arabia agreed to pay $18 billion annually into a U.S.-managed regional security fund, covering everything from naval patrols in the Strait of Hormuz to intelligence-sharing operations. That’s roughly 40% of what the U.S. currently spends on its Middle East military footprint. Third, the agreement explicitly states that Saudi Arabia considers the United States its “primary strategic partner,” a diplomatic phrasing that quietly sidelines longstanding rivals like France and the UK in arms sales.

The F-35 sale — 80 jets with options for 120 more — is the most visible symbol of this shift. For years, Washington blocked F-35 exports to Riyadh over concerns about technology leakage and regional arms races. Now, with Saudi Arabia agreeing to U.S.-controlled maintenance protocols and cybersecurity audits, those fears have been overridden by strategic necessity. “This isn’t about selling weapons,” said one anonymous senior Pentagon official. “It’s about locking in a long-term ally who can help us manage China’s growing footprint in the Indian Ocean.”

Who Benefits? American Workers, Defense Contractors, and the Budget Deficit

Trump didn’t just sell the deal as a security win — he sold it as an economic lifeline. “We’ll be paying down debt very substantially,” he told reporters. “Countries that took advantage of us? No longer.”That’s not just rhetoric. The $18 billion in annual burden-sharing payments alone would cut the U.S. defense budget deficit by nearly 5% — enough to delay planned cuts to the National Guard and fund two new Virginia-class submarines. Meanwhile, the investment influx is projected to create 420,000 American jobs over the next decade, according to a White House economic model. Most of those are in manufacturing, aerospace, and cybersecurity — sectors hit hard by offshoring.

First Lady Melania Trump was present for the official welcome on November 18, 2025, a rare public display of diplomatic formality that underscored the event’s importance. PBS NewsHour’s 46-minute broadcast that same day, titled “Trump meets MBS: The Five Big...,” highlighted the political symbolism — a president who once called Saudi Arabia a “rip-off” now embracing it as a pillar of his legacy.

Why This Matters Beyond the Headlines

This deal doesn’t just change U.S.-Saudi relations — it changes how America projects power. For decades, the U.S. has been the region’s security guarantor, often at great cost. Now, it’s becoming a service provider — paid for by allies who see the value in American deterrence. Saudi Arabia, an absolute monarchy with a human rights record widely criticized by Western NGOs, has traded diplomatic criticism for economic and military clout. And Washington? It’s trading principle for pragmatism.The timing is no accident. With Iran’s nuclear program advancing, Russia expanding influence in Syria and Yemen, and China building ports in Djibouti and Oman, the U.S. needs partners who can act as force multipliers. Saudi Arabia, with its $600 billion sovereign wealth fund and control over 15% of global oil supply, is the only player in the region who can deliver that.

But there’s a catch. Critics warn that deepening ties with Riyadh could undermine U.S. credibility on human rights. “You can’t build a moral foreign policy on $1 trillion in checks,” said Dr. Aisha Hassan, Middle East policy fellow at the Brookings Institution. “This deal says: We’ll look the other way on Jamal Khashoggi, on women’s rights, on Yemen — as long as the money flows.”

What’s Next? The Domino Effect

Already, the United Arab Emirates and Qatar are quietly exploring similar arrangements. Israel’s defense ministry has requested an emergency briefing on the SDA’s implications for its own arms deals. And back in Washington, lawmakers are scrambling to draft legislation that would codify the burden-sharing payments into law — before the next presidential election.One thing’s clear: The Trump administration didn’t just sign a deal. It rewrote the rules of American engagement in the Middle East. And for better or worse, the world is watching.

Frequently Asked Questions

How does the $1 trillion investment from Saudi Arabia differ from previous deals?

This isn’t just more money — it’s a structural shift. Previous investments were largely in real estate and energy. This round includes $340 billion in manufacturing, $210 billion in AI and quantum computing, and $180 billion in critical minerals processing — all tied to U.S. job creation mandates. The White House says 70% of these funds must be invested in U.S.-based operations, not offshore subsidiaries.

Why is the F-35 sale such a big deal?

The F-35 is America’s most advanced stealth fighter, and until now, only NATO allies and close partners like Japan and South Korea received them. Selling them to Saudi Arabia signals a major recalibration of U.S. security priorities — prioritizing strategic alignment over traditional alliance hierarchies. It also opens the door for future Saudi co-production of components, which could eventually shift manufacturing out of the U.S.

What’s in it for Saudi Arabia?

Beyond the F-35s and defense tech, Saudi Arabia gains U.S. backing for its Vision 2030 economic diversification plan — including American help building its new NEOM megacity, securing nuclear energy licenses, and accessing U.S. satellite surveillance. It also gets diplomatic cover: the U.S. has agreed not to support UN resolutions criticizing Saudi human rights practices for the next five years.

Will this affect U.S. relations with Israel?

Israel is concerned. While the U.S. insists the F-35 sale won’t alter Israel’s qualitative military edge, Israeli officials worry Saudi Arabia gaining advanced air capabilities could shift regional power balances. Behind closed doors, U.S. officials have assured Israel that Saudi jets will be restricted from operating near Israeli airspace and that intelligence-sharing will remain exclusive.

How does this impact U.S. debt?

The $18 billion in annual burden-sharing payments directly reduce U.S. defense spending obligations. Combined with interest earned on Saudi investments in U.S. Treasury securities, the White House estimates a net reduction of $42 billion in federal outlays over five years — enough to cut the 2026 deficit by nearly 3% without raising taxes or cutting social programs.

Is this deal permanent?

Not legally. The SDA is a presidential agreement, not a treaty, so it can be terminated by a future president. But the economic ties — especially the $980 billion in investments — are locked in through long-term contracts. Reversing them would trigger billions in penalties and lawsuits, making it politically and financially costly.